As another example, what about the evaluation of a business that generates $100 in income every year? What about the payment of a down payment of $30,000 and a monthly mortgage of $1,000? For these questions, the payment formula is quite complex, so it is best left in the hands of our Finance Calculator, which can help evaluate all these situations with the inclusion of the PMT function. Otherwise, they have no conclusive evidence that suggests they should invest so much money into a rental property. Investors may wonder what the cash flow of $1,000 per month for 10 years is worth. Take, for instance, a rental property that brings in rental income of $1,000 per month, a recurring cash flow. PMT or periodic payment is an inflow or outflow amount that occurs at each period of a financial stream. The fourth part is $1, which is interest earned in the second year on the interest paid in the first year: ($10 × 0.10 = $1).The third part is the other $10 interest earned in the second year.The second part is the $10 in interest earned in the first year.

#Compare hp financial calculators plus#

This $110 is equal to the original principal of $100 plus $10 in interest. How much will there be in one year? The answer is $110 (FV). Suppose $100 (PV) is invested in a savings account that pays 10% interest (I/Y) per year. This increased value in money at the end of a period of collecting interest is called future value in finance.

This is also why the bank will pay more for keeping the money in long and for committing it there for fixed periods.

This is the basis of the concept of interest payments a good example is when money is deposited in a savings account, small dividends are received for leaving the money with the bank the financial institution pays a small price for having that money at hand. The "time value of money" refers to the fact that a dollar in hand today is worth more than a dollar promised at some future time.

#Compare hp financial calculators full#

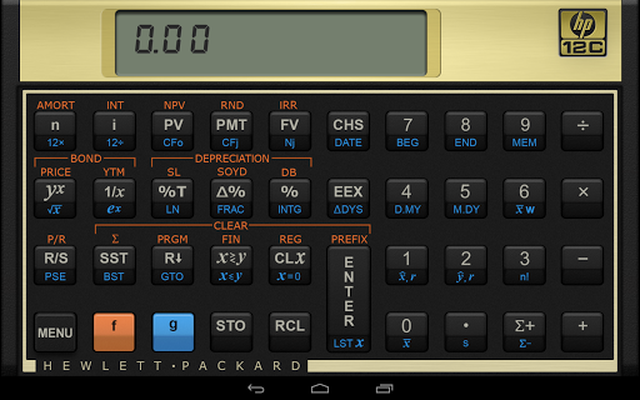

Would you rather have this money repaid to you right away in one payment or spread out over a year in four installment payments? How would you feel if you had to wait to get the full payment instead of getting it all at once? Wouldn't you feel that the delay in the payment cost you something?Īccording to a concept that economists call the "time value of money," you will probably want all the money right away because it can immediately be deployed for many different uses: spent on the lavish dream vacation, invested to earn interest, or used to pay off all or part of a loan. Periodic Payment (PMT) can be included but is not a required element. In basic finance courses, lots of time is spent on the computation of the time value of money, which can involve 4 or 5 different elements, including Present Value (PV), Future Value (FV), Interest Rate (I/Y), and Number of Periods (N). Related Loan Calculator | Interest Calculator | Investment Calculator

0 kommentar(er)

0 kommentar(er)